Guns and Letters: American Murder Weapons

How UnitedHealth Group Harms Patients Without Firearms

Brian R. Thompson, Executive Vice President of UnitedHealth Group (“UHG”), and CEO of its insurance division UnitedHealthcare (“UHC”), was shot to death in New York City Wednesday. Police have a suspect in custody, and news reports indicate he was in possession of a handwritten document excoriating the company and the health insurance industry.

Murder is a terrible crime. A member of our family was brutally murdered by a stalker several years ago. Even though the murderer was captured and imprisoned quickly, our family’s anguish, loss and fury will never fully subside. I didn’t know Brian Thompson. Healing and Stealing’s deepest sympathies go out to his loved ones.

Yet the horror of his death and our sympathy for his family’s pain should not obscure the fact that Brian Thompson’s life was extinguished by gunfire while he led a company that maimed and killed thousands of people simply by mailing letters, while keeping billions of dollars his victims paid him and his company to take care of them.

For decades U.S. business, political and media leaders have pretended the suffering and death of those victims is somehow normal, expected and accepted, even though we spend twice as much per person as other wealthy countries for the ostensible purpose of preventing and treating the maladies that afflict those patients and too often take their lives. This must stop.

Under Thompson’s leadership, UHC - like all private insurers - earned billions in profits by charging employers and the government much more money to insure people than the cost of the government covering them directly. Although it’s the largest health insurer in the U.S. with 47 million people enrolled in its plans and $372 billion in 2023 revenue, UHG can’t or won’t use its market muscle to control the cost of care effectively. So the company’s “products” leave people who are nominally insured without real protection from illness or injury.

According to the Commonwealth Fund, 48% of working age adults skipped needed medical care due to out of pocket cost in the past year, including 36% of those who are supposedly well-insured by companies like UnitedHealth Group.

Pricing people out of using their supposed insurance was just the start. In the name of their own failed “cost control,” UnitedHealthcare under Thompson also denied approval or payment for care for millions of sick and injured people, despite those patients, their employers and the government paying constantly increasing premiums for coverage. It continues to do so today.

Care Promised and Denied: ValuePenguin, a consumer website run by online lender LendingTree, analyzed CMS data and found that for plans sold through the ACA marketplaces or the individual insurance market, UnitedHealthcare denies 32% of claims, with the biggest reasons being a failure to get “prior authorization” and disputes over whether a provider is in the plan’s network. Assuming ValuePenguin’s analysis is correct, it’s the highest rate in the industry.

Prior authorization means that for certain types of tests, treatments and prescriptions, patients and/or providers have to ask permission in advance. It’s only one way insurers refuse to pay for the care they’re supposed to cover, but it illustrates the entire wealth extraction process.

Thompson became Executive Vice President of UHG and CEO of its insurance division in April 2021. Back in 2018 he was still only “CEO of UnitedHealthcare’s government programs,” responsible for the company’s Medicare and Medicaid insurance plans (UHG apparently employs a lot of CEOs). Early that year, a UHC plan denied attorney and disability rights leader Carrie Ann Lucas a prescription for an inhaled antibiotic, according to a remembrance in Forbes. Lucas, who lived with muscular dystrophy, Type I diabetes and other serious health issues, suffered a reaction to a cheaper drug that triggered a series of health problems. She died February 24, 2019.

Also in 2019, according to a report by the staff of the Senate Permanent Subcommittee on Investigations, UnitedHealthcare’s Medicare Advantage plans denied 8.9% of requests to authorize rehabilitation care for patients discharged from acute hospital care. By 2022, as Thompson rose through the company’s upper echelons, the rate had ballooned to 22.7%.

KFF Health News analyzed data from Medicare Advantage (“MA”) and found that on average insurers received 1.7 prior authorization requests for each enrolled patient in 2022. UnitedHealth fell below the average, but still processed nearly one prior authorization request for every MA patient they cover, an estimated 6.2 million requests.

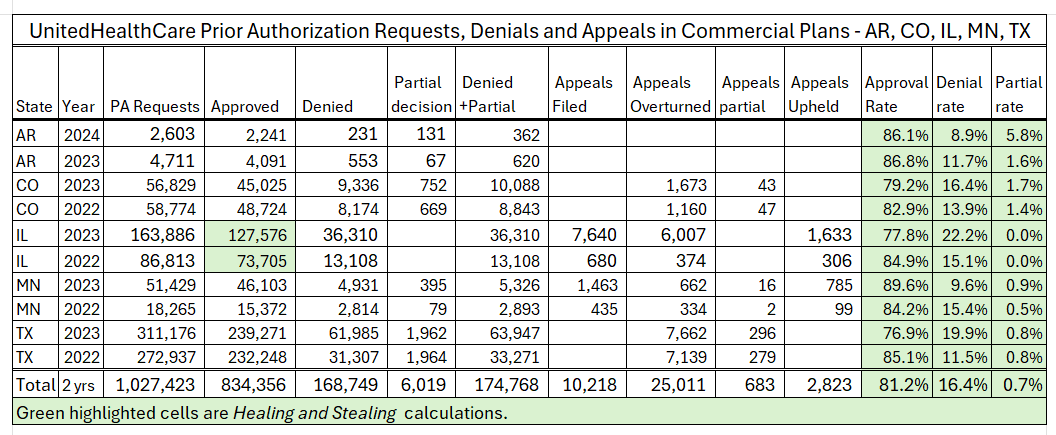

UHC doesn’t release comprehensive prior authorization data for its other types of insurance, but five states force them to release some comparable data on their commercial plans, available at UnitedHealth Group’s website. Along with the KFF MA analysis, the numbers paint a portrait of mass suffering triggered by administrative stonewalling.

UHC’s MA plans denied 8.7% of prior authorization requests in 2022, or more than 530,000 denials, but the bureaucratic hell UHC created for its commercial patients may be twice as hot. Over the 2 most recent years for which we have data, UHC denied 16.4% of requests for prior authorization for patients in commercial plans in Arkansas, Colorado, Illinois, Minnesota and Texas.

At least patients occasionally appeal prior authorization denials and win. Only 12.6% of MA patients who received a UHC prior authorization denial appealed, but they won reversals 86% of the time. Yet, perhaps because providers often lead the bureaucratic charge before treatment, patients appeal prior authorization denials far more often than the other ways insurers refuse to pay for the care they’ve promised, and patients appear to win more often.

A different KFF study of ACA marketplace plans found that for all types of in-network claims denials “in 2021, HealthCare.gov consumers appealed less than two-tenths of 1% of denied in-network claims, and insurers upheld most (59%) denials on appeal.” There was no meaningful data for UHC plans in 13 of 15 states studied, but in Arizona and Tennessee, UHC plans denied 39% and 25% of claims. Only 3.8% and 4.5% of patients appealed, with 41% and 33% of denials overturned.

Even accepting the dubious proposition that the denials upheld on appeal are all legitimate, the data strongly suggest that millions of UHC patients gave up and accepted claims denials that never should have been issued.

Ultimately, denial means either a patient pays for care out of pocket or skips it. Fully 40% of adults who skipped needed medical care due to cost in the Commonwealth Fund survey said their conditions worsened.

CEO of Broken Promises Earns $30 Million: Brian Thompson was well-compensated for supervising UHC’s denial bureaucracy. His 2021 promotion made him one of parent corporation UHG’s five “listed officers” whose compensation must be disclosed to the Securities and Exchange Commission (SEC). According to the company’s proxy statement filed April 22, 2024, UHG paid Thompson $29.8 million in total compensation over 3 years from 2021 to 2023, including salary, stock grants, options and cash incentives.

Thompson’s pay structure put his personal interests in direct conflict with the needs of patients covered by the company. Just 10% of Thompson’s pay came in the form of his $1 million base salary. The company paid nearly all of the other 90% through cash incentives (“Non-Equity”), outright grants of shares of the company’s stock and options to purchase additional shares at a set price, highlighted in green:

UHG paid Thompson these amounts based on his and the other listed officers’ efforts to meet short- and long-term performance incentive goals. The two heftiest categories, stock awards and options ($22 million), were based entirely on meeting goals for two measures of long-term profitability. Every nickel paid out on behalf of patients potentially took a bite out of Thompson’s wallet.

United and other insurers justify prior authorization as necessary to “control costs” by stopping doctors from prescribing inappropriate treatment. Although usually couched in bland corporate language, the rationale paints a picture of greedy doctors stuffing unnecessary or unreasonably expensive care down the throats of pampered patients.

It’s a phony narrative. We get much less health care than people in other wealthy nations. But UnitedHealth Group - before, during and after Brian Thompson’s tenure - and the entire private insurance industry have failed utterly to control the price of medical care, even though that’s a critical part of the promise they make to us when we pay our premiums. They’re supposed to “manage” the cost of care, and they can’t or won’t, perhaps because, paradoxically, the rising price of health care doesn’t really hurt UHG’s bottom line.

Employers can’t switch health insurers as easily as they can change vendors if they find a slightly cheaper source of office supplies. So insurers can often get away with premium increases at multiples of inflation every year without their business collapsing. They’re allowed to keep 20-25% of those premiums by law and 25% of a trillion dollars is a lot more than 25% of a half trillion. It’s also just much easier to design algorithms to harass individual patients and doctors on a case by case basis than to win price negotiations with corporate behemoths like UChicago Medicine, HCA and multi-billion dollar affiliates of the Catholic Church.

Respectable Mobsters: There are words for people who take money from others while promising to protect them, then keeping the money and allowing some of their “customers” to be hurt or killed by the very thing they’re supposed to be protected from: brigand; gangster; mobster.

These terms may sound harsh when applied to people like Brian Thompson - respectable businesspeople attending respectable investors’ conferences filled with people in expensive suits. That is, until you remember that Thompson and his gang rub their victims’ noses in their humiliation as crudely as any Soprano or Corleone family member with politicians in his pocket:

Every year Brian Thompson and his senior colleagues gave a chunk of their loot to politicians’ campaigns to make sure that their current and future victims would never have real protection from illness and injury.

When adjusted for inflation, UnitedHealth Group and its employees spent $45 million on federal elections between 1992 and 2024, almost evenly split between Republicans (49%) and Democrats (46%), according to data from Opensecrets.org analyzed by Healing and Stealing. That’s only federal election spending, excluding contributions to elections for state offices.

From 1998 to November 2024, UHG spent $133 million lobbying Congress and White Houses of both parties, according to data gathered by OpenSecrets.org, also adjusted for inflation. In case there’s any question what that money was for, here is a screenshot from UHG’s congressional lobbying disclosure form for the third quarter of 2020.

This form only shows direct lobbying by company employees. UHG also bought top dollar help to make sure Medicare remains open for looting. If Democrats threaten to regulate the use of AI in Medicare Advantage claims denials, you might want to have former Chiefs of Staffs to House Democratic Leader Richard Gephardt (MO) and current Democratic Leader Hakeem Jeffries (NY), and the former Policy Director of the House Hispanic Caucus go to bat for you, all for just $90,000 per quarter. Meet Avoq, LLC, from their 3rd quarter 2024 disclosure for their team’s work for UnitedHealth Group†:

Democratic heavy hitters may have helped with the White House and Senate this year, but the House of Representatives was in Republican hands. Although Avoq includes a former GOP staffer on its UnitedHealth team, they’re primarily a Democratic firm. A former Chief of Staff to Senator Ted Cruz (R-TX) who is also former Executive Director of the House Freedom Caucus, anchor of the pro-Trump GOP right wing, brings a whole different vibe to your corporation’s vigorous exercise of its 1st Amendment rights. And it only cost another $90,000 for AxAdvocacy Government Relations to weigh in on Medicare Advantage issues during the third quarter of 2024:

The $1,500,000 UHG spent on lobbying over those three months included payments to six other firms who assigned a bipartisan phalanx of former White House special assistants and congressional chiefs of staff to make sure the company’s opportunities to profit from Medicare and avoid commercial regulations continue. Of course, this is only federal lobbying. There’s also the millions the company spends lobbying state legislatures for the right to loot Medicaid.

A Health Care and Well-Being Company: UnitedHealth Group describes itself as “a health care and well-being company with a mission to help people live healthier lives and help make the health system work better for everyone.” Let’s review UHC’s approach to the health and well-being of the 47 million Americans they supposedly covered during Brian Thompson’s tenure and beyond:

UnitedHealth promises to pay for health care

Employers, governments and individuals pay premiums based on that promise

UnitedHealth’s insurance plans are so costly that they demand heavy out of pocket payments from their “customers”

As a result, large percentages of UnitedHealth’s members don’t even bother to use their benefits when they need health care, boosting the company’s profits.

Those who do try to get care frequently receive a letter denying authorization in advance or payment after the fact for their care

Patients and providers spend long hours trying to reverse the denials. Appeals sometimes win, but faced with battling a $372 billion colossus on their own, most patients just give up and either skip care or go into crushing debt.

Skipping care makes people get sicker and sometimes die.

These administrative attempted murder letters can be as deadly as a gunshot, and have been fired at millions of people.

UnitedHealth pays its senior executives millions of dollars a year based on their success extracting profits from patients’ physical, mental, emotional and financial pain.

They lavish extracted wealth on political campaigns and the ex-politicians who lobby the winners to keep their racket going and make sure their victims will never have real protection from illness, injury and death

At the end of his life, Brian Thompson held a powerful and lucrative job. That job never should have existed.

Private health insurance in the U.S. is an eight-decade failed social experiment. Yet politicians from both parties continue to insist that we’ll eventually get the care we need if we just wait for the exact right tweaks to market forces. All of them - from Richard Nixon and Ted Kennedy through Presidents Carter and Reagan, the Clintons, both Bushes, Obama, Trump, Biden, Senate leaders Schumer, McConnell and Graham, Speaker Pelosi, her Democratic forbears and successor Leader Jeffries, Speaker Johnson and the endless parade of other replaceable mediocrities who stumbled into the Speaker’s chair every few months when the GOP last had a majority - bear responsibility for the looting and carnage sown by UnitedHealth Group’s senior executives.

The fact that Brian Thompson lived the life of a respectable mobster in no way justifies his murder. It now appears that the suspected shooter may have been motivated by frustration with the health care system as a whole and with UnitedHealth’s decisions in particular, but killing an individual executive is no legitimate remedy. In the end, Brian Thompson will be replaced at UHG by another eager sender of murderous letters and faxes as his family mourns his passing.

And patients will keep suffering, dying and going bankrupt by the millions until we remove the entire class to which Thompson belonged from power over our health.

†The company’s name is actually “Avōq” but we were concerned that the accented “o” might not come through in an email, so used the English character.

A LITTLE EXTRA FOR THE DATA CURIOUS

Healing and Stealing has published a lot of the data in this story in earlier pieces and the data at most of the links in the story is self-explanatory. Here’s where we’ve added value or where the information may not be very well known.

Prior Authorization and Denials for Commercial Plans: UnitedHealth has published data on prior authorization requests, approvals, denials and appeals in commercial plans for six states: AR, CO, IL, IN, MN, TX, apparently only because those states require it. The releases include data points and categories that vary by state, and are formatted inconsistently - the company publishes appeals data in some states and not for others. Healing and Stealing encourages readers to examine it for themselves. The data for Indiana has no raw totals and is incomplete. The spreadsheet with the data for the table in the text is available to readers. Just leave a comment or send an email to jcanhamclyne@gmail.com. The original sources are available at UHG’s website. The were downloaded on December 5, 2024.

The data on the volume of appeals in commercial plans varies widely and is only available for two states, so we omitted it.

Incentive Payments: The 2024 proxy linked in the story describes Brian Thompson’s incentive compensation plans in detail. Stock awards (outright grants) and options are based on 3-year goals for Adjusted Earnings Per Share and Return on Equity, both measures of the shareholders’ profitability. The company exceeded the performance targets set for the listed officers by the Board of Directors’ Compensation Committee for 2023, but fell short of the benchmark that would have yielded maximum compensation.

47 million subscribers, $372 billion in revenue: Data for 2023, from UnitedHealth Group Securities and Exchange Form 10-K for the year ending December 31, 2023. See “Consolidated Statements of Operations,” page 39, and table on page 28.

Campaign and Lobbying Spending: The data for federal election spending and lobbying are drawn from Opensecrets.org’s profiles of UnitedHealth Group and subsidiaries. Links are in the article. Opensecrets data is dynamic - the organization updates it regularly as entities report to the FEC and the congressional lobbying office. Since the campaign spending figures do not include the whole 2024 cycle, researchers seeking to replicate the work will likely find differences in the totals.

Below are images of the data tables. The campaign spending shows real dollars only. The lobbying spending includes the CPI adjustment factors and both nominal and real dollar values. Healing and Stealing is happy to share the spreadsheets for both. The data were adjusted for inflation using the annual average unadjusted consumer price index for all urban consumers, where: Current value of $ in past year = [$past year × (Current CPI/CPI past year)]. Detail on the formula is available from St. Louis Federal Reserve Bank.

LOBBYING:

CAMPAIGN SPENDING: The OpenSecrets.org data for parties includes contributions by company-controlled political action committees (PACs) and individual UHG employees to campaigns and partisan-affiliated Political Action Committees. It’s likely that at least some of those contributions are made independently of the company’s corporate interests, but since the Federal Election Commission only releases data for individuals who give at least $200 in a cycle, it’s reasonable to assume that most of the individual contributions are made in part to further UHG’s interests.

The amounts that are not counted as going to a party represent contributions to independent expenditure campaigns or direct spending on campaign issue ads. Again, these data are adjusted for inflation and will not match the raw data at OpenSecrets.org