Medicare Advantage Insurers Get 5% Raise

Trump Gives Wasteful, Fraudulent Abusers a $25 Billion Bump

On April 6, President Donald Trump, Health and Human Services Secretary Robert F. Kennedy Jr. demolished what little credibility they might have had as warriors against health care “waste, fraud and abuse.” They gave Medicare Advantage insurers - contractors in the privatization of public health insurance for people with disabilities or age 65 or older - a 5% raise in their base premium rates. That’s $25 billion in new spending for a program that has never paid for itself.

Under at least four different names and presidents of both parties, Medicare Advantage (MA) has wasted more money and allowed corporations to perpetrate more fraud and abuse than any other government health care program. While Elon Musk publishes meaningless spreadsheets falsely claiming that millions of dead people are collecting Social Security checks, Trump and Kennedy guaranteed that MA will keep churning out corporate profits at public expense for another year.

Three weeks ago, the Centers for Medicare and Medicaid Services (CMS), a sub-unit of Kennedy’s HHS, announced that its “benchmarks” for payments to insurance companies selling MA and prescription drug (“Part D”) plans would increase an average of 5.06% next year, leading to an estimated increase of $25 billion in spending on private health plans - and it’s only one of many tools the federal government uses to boost MA plans’ profits. The increase is more than twice what the Biden Administration proposed for 2026. According to The Wall Street Journal, financial markets appreciated the news.

Since Medicare became law in 1965, Congress has:

Funded the original Medicare program that allows patients free choice of doctors and hospitals at levels that leave beneficiaries with heavy premiums and out-of-pocket costs - there isn’t even a cap on patients’ total out-of-pocket payments (see “Fully Fund Medicare Now!” 10/11/2023).

Allowed Medicare to pay for benefits through private health insurance plans, as long as they offer a cap on out-of-pocket expenses, and where they can afford to, additional benefits not available in original Medicare.

As Harvard economists Thomas McGuire, Joseph Newhouse and Anna Sinaiko put it, subcontracting Medicare to private insurance corporations was supposed to result in “transferring to the Medicare program the efficiencies and cost savings achieved by managed care in the private sector.” It hasn’t worked out that way.

Enrolling patients in private MA plans has always cost more than Medicare would have spent than if people stayed in original Medicare. MA cost Medicare between $88 and $172 billion in overpayments in 2022. What has become a decades-long corporate looting operation relies on three primary scams:

Enroll Healthier People (“Favorable Selection”): When MA really got rolling in 1984, Congress set the premiums for private plans at 95% of the average Medicare spending per person in a county. That was Washington’s big “prove it” challenge to private insurers’ “efficiency.” The people who signed up for private plans turned out to be more than 5% healthier or otherwise less likely to use health care than the broader population. So corporations made money while the public lost.

Lie About Those Healthier People (“Coding Intensity”): MA premiums and reimbursement are now adjusted with a specific “risk score” for each individual. Lo and behold, private insurers’ payment requests have more “complete” diagnoses than billing claims for original Medicare patients. Company nurses on wellness visits find medical conditions that patients’ doctors somehow missed.

Rip Those Healthier People Off: The trade-off for the lower out-of-pocket costs in MA is giving a profit-oriented bureaucracy decisionmaking power over your health. Allegedly illegal or unreasonable refusals to pay for covered treatment have plagued MA from the start. Using artificial intelligence algorithms to intensify abusive denials is now the subject of class action lawsuits and congressional reports.

A LOOTING ROADMAP: In its March 2025 annual report, Congress’s formal Medicare advisory body, the Medicare Payment Advisory Commission (MedPAC), projects that payments to private insurers will cost Medicare $84 billion more than what the program would have paid if those patients stayed in original free choice Medicare this year. MedPAC estimates that $44 billion is a result of “favorable selection” and $40 billion arises from “risk adjustment and coding intensity.”

The MA chapter in the MedPAC report runs to 87 pages. Read carefully and with a basic understanding of Medicare and MA, it resembles detailed class notes for a graduate seminar in looting the public purse. Every single step of the rate-setting process is designed to ensure profits, no matter how the industry performs.

Avoiding the temptation to review the entire syllabus, here’s one example each of how waste, fraud and abuse guarantee profits for private Medicare Advantage insurers, and how successive “reforms” have been inverted to make sure even more companies make more money. Enabling the looting of hundreds of billions of dollars has been a bipartisan effort over the years, but by injecting more cash into these schemes, Trump and Kennedy mock their own good government rhetoric.

CHOOSING PROFIT OVER EFFICIENCY [WASTE]: The best scams operate at the level of assumption. Few assumptions in American life are more powerful than that “choice” is always a good thing. Although MedPAC regularly criticizes aspects of MA, they support using private insurance in Medicare because:

“Beneficiaries should be able to choose among Medicare coverage options since some may prefer to avoid the constraints of provider networks and utilization management by enrolling in FFS Medicare, while others may prefer features of MA, like reduced premiums and cost-sharing liability.” (“FFS” here means original free choice Medicare - ed.)

Never mind that the “choice” in question is between not being able to afford health care and being promised slightly more affordable health care with a serious risk that private insurers will break that promise. In the name of “choice” Congress and successive White Houses have chosen to overpay private insurers by tens of billions of dollars a year instead of using the money to pay for the dangerously high levels of cost-sharing in original free choice Medicare.

Medicare Advantage companies are supposed to be paid through “capitation.” In theory, insurers get a set amount per patient in advance and that’s it. You have to use that money to take care of patients and still earn a profit - the basis for the early “prove it” test for efficiency. Take a flat rate of 95% of the cost of the average Medicare beneficiary in your county, take care of patients, earn a profit and let’s all benefit from your efficiency.

Make money they did, but from a policy perspective, the insurance industry flunked that test catastrophically. People enrolling in private plans were so much healthier than average - “favorable selection” - that 95% of a region’s average spending produced wild overpayment compared to what original free choice Medicare would have paid.

In certain regions, though, the skim wasn’t enough to entice enough private health insurance plans to participate to guarantee enough “choice.” So even though the standard 95% benchmark drove the feds to overspend compared to original Medicare, Congress and Medicare decided to increase the percentage. MA benchmarks are now “set above FFS [original Medicare] spending in many markets in part to encourage more uniform plan participation across the country.”

CMS also pays insurers “quality” bonuses, although MedPAC says there is no persuasive evidence of a difference in quality between original Medicare and private insurance. Quality bonuses and raising the benchmark percentages have increased actual payments to an average of 108% of what is spent on original Medicare patients - even before accounting for the effects of enrolling people who use less health care than average and lying about how sick MA patients are.

Trump and Kennedy are increasing the base amount that gets multiplied by that 108% by 5%, more than twice what the Biden Administration initially estimated the increase should be.

ADJUST YOUR OWN PAYMENTS [FRAUD] : Getting overpaid because your population is so much healthier than average and then convincing Medicare to increase how much you get compared to what the government spends on the average patient is an impressive lobbying feat, but it’s just the beginning.

Befuddled by the difference between the people who signed up for MA plans and the people who stayed in free choice Medicare, Congress and CMS tried to fix the overpayment problem by adjusting federal payments to private insurance corporations with a specific “risk score” for each patient enrolled in a private plan.

And who determines the risk score? Well, the federal government has a “model.”

However, CMS only feeds basic demographic information like patients’ age, gender, income and residence into the algorithm. The most important data that determines how much Medicare increases its payments to health insurance companies because of patients’ “risk” originates with…

…health insurance companies themselves.

In free choice Medicare, doctors are paid primarily based on the treatments they deliver. Both the actual treatments a patient receives and the diagnosis for that care are documented with a series of codes recorded on billing claims submitted to CMS.

Early on in Medicare privatization, none of that was supposed to matter. You were supposed to profit by having money left over from your up-front payments after “efficiently” managing medical expenses. Under capitation, individual patients’ health histories and the coding their doctors put on bills were supposed to be irrelevant.

But when Medicare started adjusting payments to private insurers for the financial risks of each individual patient in 2007, it mattered. A lot. The codes on billing claim forms that providers send to private insurers for patient “encounters” became the most important element of the risk score. Last year’s illnesses, injuries and treatments determine this year’s risk score and this year’s payments.

Unfortunately for MA insurers, doctors and hospitals tend to code things that matter for payment, but not much else. With billions of dollars in sight, the insurance industry got serious about documenting patients’ maladies.

Company doctors started comparing incoming billing claims for “encounters” between doctors and patients with actual medical records, in case a patient’s doctor missed a diagnosis or two (“chart review”). Insurance company nurses turned annual “wellness visits” to patients’ homes into “health risk assessments” that often add diagnoses to medical records that patients’ own doctors didn’t find, including new diagnoses for patients who haven’t had any encounters with their doctors at all.

Last year, a Wall Street Journal investigation found $50 billion in excess payments due to health risk assessments. Insurers diagnosed 66,000 patients with diabetic cataracts who had already had cataract surgery to replace the lens in their eyes. University of Alabama at Birmingham specialist Dr. Hogan Knox told the Journal that getting cataracts on an artificial lens is “anatomically impossible.” Once the original lens is removed, “the cataract never comes back.”

HHS Inspector General audits of coding for some of the conditions that yield high risk scores found that “70 percent of all diagnosis codes audited were not supported by medical records and that some diagnoses were not supported over 90 percent of the time,” according to MedPAC. Driven by newer, truthier data from chart reviews and risk assessments, MedPAC estimates that “coding intensity” will cost Medicare $40 billion in extra payments this year.

Corporate “upcoding” in Medicare isn’t new. Congress gave CMS the authority to adjust risk scores down to size 15 years ago. But the industry’s “coding intensity” has stayed well ahead of the game across administrations and Congresses of both parties, as MA enrollment has grown to the majority of people eligible for Medicare.

SICK ENOUGH FOR PROFITS BUT NOT FOR TREATMENT [ABUSE[: Insurers may cash in by telling the federal government their patients are very sick, but they also make money by telling doctors the opposite.

MA plans require patients and providers to get approval in advance from private bureaucrats for a wide array of covered Medicare services, or else the insurers won’t pay for them. According to a KFF.org report, providers and patients submitted 49.8 million requests for prior authorization for Medicare Advantage patients in 2023. That’s 1.8 requests for every person enrolled in a private Medicare plan.

By contrast, original free choice Medicare has a small prior authorization program that generated 393,749 requests in 2023, “a rate of about 0.01 per person” according to KFF. At that rate, doctors and other providers were forced to ask for bureaucratic approval roughly 180 times more often for their MA patients than for their original free choice Medicare patients.

Private insurers denied approval for 6.4% of prior authorization requests. Some patients likely had more than one request denied, so the true number will be lower, but the numbers suggest that on average 11.5% of MA patients were denied a prior authorization approval. Patients have the right to appeal, and those who do appeal often have their denials overturned, as I did last year (“Our Own Private Hells” 7/18/24). But appeals are rare, so most denials stand.

According to CMS, “[t]he purpose of prior authorization is to ensure that treatments are medically necessary, helping to control costs and prevent unnecessary healthcare services.” Private insurers told millions of doctors that their patients weren’t sick or injured enough to need the treatments that their doctors ordered. A very different message than those same companies send to CMS when they submit patient “risk scores,” with enhanced “coding intensity” to drive up their own payments.

PERFECT BIPARTISAN SUCCESS: Medicare Advantage law is loaded with these kinds of looting tools. Insurers submit “bids” for each county with the percentage of the area’s original Medicare spending the company thinks it needs to cover people. They’re typically lower than the “benchmark” percentage, but CMS pays them the difference between the county benchmark and their bid as a “rebate.” The rebate must be used either for additional benefits not available in free choice Medicare, like reduced cost sharing, vision or dental services, or to cover some administration and profit. Although rebates now account for 17% of all payments, no one knows how well supplemental benefits work for patients. Here’s MedPAC:

As a former mediocre lobbyist, I must confess a guilty admiration of the industry’s mastery of the craft of influence peddling. The benchmark system and risk score reforms should be studied by political scientists and aspiring “government relations” consultants for years to come.

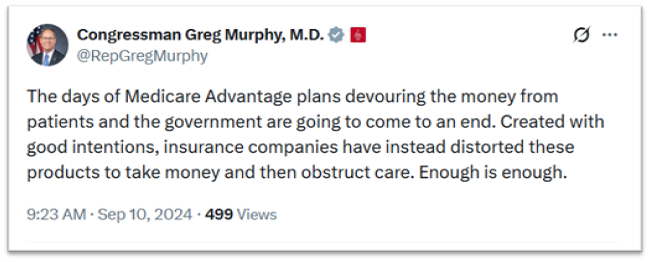

This year Medicare Advantage will be 20% more expensive than having the federal government cover the same people directly, 60 years after the first experiments and 40 years after the program really got rolling. It’s a perfect bipartisan policy success. GOP congressional doctors and former House Progressive Caucus Chairs alike are performing outrage at MA on social media, which probably signals another round of public hearings laden with horror stories. But given the history, the odds that any “reforms” will actually save money or improve Medicare patients’ access to health care are slim. Never mind taking the obvious step of abolishing a program that has failed for decades and using the billions in savings to improve Medicare.

A LITTLE EXTRA FOR THE DATA CURIOUS

Most of the information in this piece is drawn from the March 2025 MedPAC report, unless otherwise cited. Healing and Stealing made 2 additional calculations to the data in the KFF report on prior authorization.

“roughly 180 times more often”: According to KFF, there were 1.8 requests for prior authorization per Medicare Advantage beneficiary in 2023, and “about 1 prior authorization review per 100 traditional Medicare beneficiaries in 2023 – a rate of about 0.01 per person.” 1.8/.01 = 180.

“on average 11.5% were denied”: 6.4% of requests were denied, a rate of 1.8 per person - .064*1.8 = .1152

Coding Intensity: Medicare Advantage looting is an open secret in Washington DC. . Some of the foundational academic and government research on “coding intensity” can be found here, here, here, here, here, here, and here.